Recently Purchased Properties

House – 3 bed, 2 bath, 4 car, 1617 sqm

$2,305,000

House – 4 bed, 2 bath, 1 car, 835 sqm

$1,955,000

House – 5 bed, 2 bath, 2 car, 520 sqm

$2,815,000

Apartment – 3 bed, 2 bath, 2 car, 155 sqm

$1,740,000

House – 3 bed, 2 bath, 3 car, 1389 sqm

$3,600,000

House – 4 bed, 2 bath, 2 car, 714 sqm

$2,100,000

House – 4 bed, 2 bath, 2 car, 721 sqm

$2,325,000

House – 4 bed, 3 bath, 2 car, 670 sqm

$2,220,000

House – 3 bed, 2 bath, 2 car, 687 sqm

$2,125,000

House – 5 bed, 5 bath, 3 car, 2,061 sqm

$5,500,000

House – 3 bed, 3 bath, 2 car, 500 sqm

$4,950,000

House – 3 bed, 2 bath, 2 car, 715 sqm

$2,600,000

Apartment – 1 bed plus 1 study, 1 bath, 1 car

$960,000

House – 5 bed, 3 bath, 2 car, 613 sqm (dual income property)

$962,000

Unit- 1 bedroom, 1 bath, 1 car, 84 sqm

$875,000

House – 3 bedrooms, study, 2 bath, 2 car, 2 living, 846 sqm

$2,357,000

Unit – 2 bedrooms, 2 bath, 1 car, 102 sqm – Location..Location!

$1,270,000

House – 4 bedrooms, 3 bath, 2 car, Ocean view

$3,350,000

Unit – 1bed, 1 bath, 1 car, view

$1,265,000

Townhouse – 3-4 Bedrooms, 3 bath, 2 car, pool in complex

$2,100,000

House – 3-4 Bedrooms, 2 bath, 2 car garage, 696 sqm

Under $2.5m

House – 5 bed, 4 bath, 3 car, 1900 sqm

$4,800,000

House – 3 bed, 3 bath, 2 car

Under $2.3m

Unit – 2 bed, 2 bath, 2 car

$1,540,000

House – 3 bed, 1 bath, 2 car, 689 sqm

$1,960,000

Townhouse – 4 bed, 2 bath, 2 car

$2,640,000

Unit – 2 bed, 2 bath, 2 car

$1,300,000

House – 4bed, 3 bath, 2 car, 948 sqm

$2,050,000

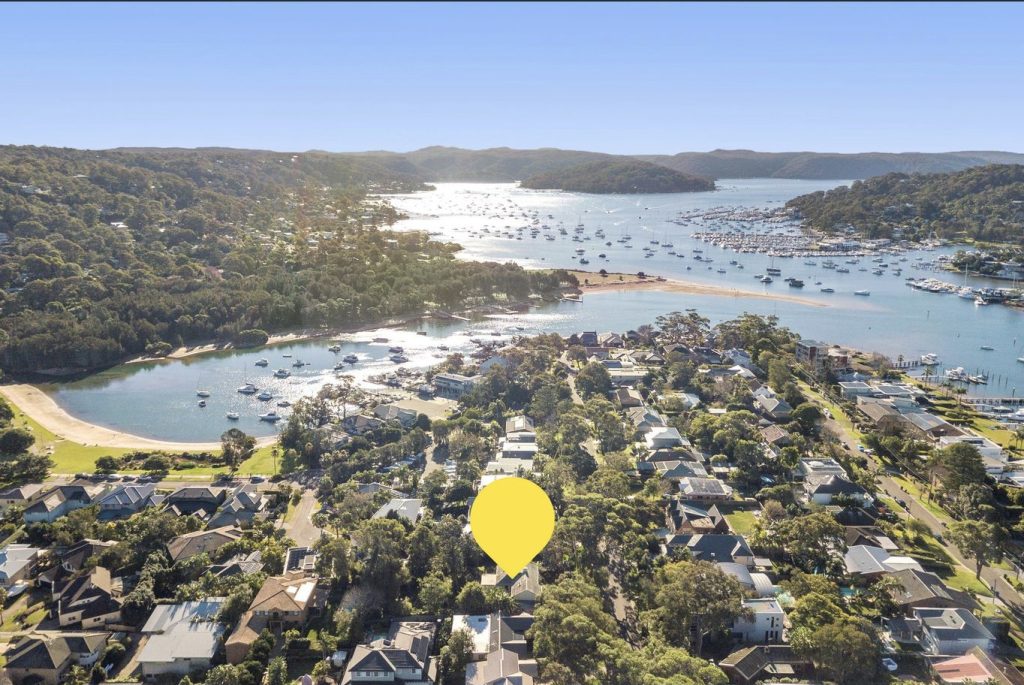

House – 4 bed, 3 bath, 2 car, 695 sqm, pool, 180 degree Pittwater views

$3,870,000

House – 4 bed, 2 bath, 2 car, 539 sqm, Pittwater views

$2,321,000

House – 4 bed, 3 bath, 2 car, 527 sqm

$3,000,000

House – 5 bed, 3 bath, 2 car, 540 sqm, pool,

$2,601,000

House – 4 bed, 3 bath, 2 car, 771 sqm, pool, Lakefront

$3,300,000

House – 5 bed, 2 bath, 2 car, 638 sqm, Pittwater Views

$2,500,000

Unit – 2 bed, 1 bath, 1 car

$955,000

House – 4 bed, 3 bath, 3 car, 613 sqm, pool, ocean view

$2,950,000

Unit – 2 bed, 1 bath, 1 car

$1,185,000

House – 7 bed, 5 bath, 3 car, 720 sqm, waterfront reserve, water views

$8,000,000

Unit – 3 bed, 2 bath, 1 car

$1,180,000

Land – 964 sqm

$1,255,000

House – 5 bed, 2 bath, 3 car, 658 sqm

$1,857,000

House – 3 bed, 2 bath, 2 car, 1322 sqm

$2,200,000

House – 4 bed, 2 bath, 2 car

$1,850,000

House – 4 bed, 2 bath, 3 car, 620 sqm

$1,790,000

House – 3 bed, 2 bath, 1 car, 474 sqm

$2,350,000

House – 3 bed, 2 bath, Jetty, Waterfront

$2,690,000

House – 3 bed, 2 bath, 1 car, 1505 sqm

$2,900,000